Des articles universitaires aux études de marché, la recherche est au cœur de votre activité. Il ne s'agit pas seulement de trouver des informations — il s'agit de trouver des informations fiables.

Avec autant de méthodes disponibles, du qualitatif au quantitatif, de l'expérimental à l'ethnographique, choisir la bonne est crucial. Mais d'abord, vous devez vous poser la grande question : recherche primaire ou secondaire ?

La distinction semble simple. La recherche primaire consiste à collecter des données originales. La recherche secondaire consiste à analyser ce qui existe déjà. Mais c'est bien plus complexe que cela.

Il existe différents types de recherche primaire et secondaire, mais lequel vous convient ? Ce guide détaille tout. Nous couvrirons ce que chaque type de recherche implique, les avantages et inconvénients, et comment procéder sans compliquer les choses.

La recherche primaire

Qu'est-ce que la recherche primaire ?

La recherche primaire est, par définition, entièrement originale. Elle consiste à aller directement à la source, en collectant vos propres données pour répondre à vos questions spécifiques. On l'appelle aussi recherche de première main, originale ou de terrain.

La recherche originale est utilisée dans de nombreux secteurs. Les journalistes l'utilisent pour vérifier les faits. Les entreprises l'utilisent pour comprendre leurs audiences. Les universitaires l'utilisent pour générer de nouvelles connaissances.

La recherche primaire est extrêmement importante. Sans elle, il n'y aurait pas de recherche secondaire, car il n'y aurait pas de données existantes à analyser. Et parce que les données sont fraîches et ciblées, la recherche primaire est souvent considérée comme la référence.

La contrepartie ? La recherche primaire nécessite de la planification, de l'argent et du temps. Mais en retour, elle fournit des informations précises et actualisées et peut donner un avantage concurrentiel à votre recherche.

Types de recherche primaire

Vous avez décidé que la recherche originale est la voie à suivre ? L'étape suivante est de choisir votre méthode de recherche primaire. Le bon choix dépend largement de votre objectif : des données larges et évolutives ou des informations détaillées.

Les types courants de recherche primaire incluent :

- Sondages et questionnaires : Retours structurés de groupes importants.

- Entretiens qualitatifs : Conversations approfondies explorant opinions, expériences et motivations.

- Entretiens quantitatifs : Questions standardisées produisant des données mesurables.

- Groupes de discussion : Discussions guidées révélant comment les gens interagissent et forment leurs opinions.

- Observation et recherche ethnographique : Observer les comportements dans des contextes réels.

- Expériences et tests : Essais contrôlés, tests A/B ou programmes pilotes pour voir ce qui fonctionne (et ce qui ne fonctionne pas).

Pour les entreprises, la recherche primaire est souvent le premier choix. Elle produit les informations les plus directes sur l'audience cible, qu'il s'agisse de clients, de prospects ou même de concurrents.

Les entreprises mènent des études de marché primaires pour :

- Tester comment un produit sera reçu avant son lancement

- Comprendre les besoins et comportements des clients

- Identifier les lacunes du marché ou de nouvelles opportunités

La recherche de marché primaire donne aux organisations la confiance nécessaire pour prendre des décisions basées sur des retours directs, pas sur des suppositions.

Comment mener une recherche primaire

Prêt à vous lancer dans une méthode de recherche primaire ? Voici une approche simple étape par étape.

Étape 1 – Définissez vos questions de recherche : Que devez-vous découvrir ? Réfléchissez soigneusement à vos questions, à la pertinence des réponses attendues — et à leur faisabilité.

- Conseil : Ne vous surchargez pas avec trop de questions de recherche générales. Une seule question peut déjà être très chronophage. Restez concentré : une à trois questions clés suffisent.

Étape 2 – Choisissez votre méthode : Réfléchissez à la méthode la plus adaptée à vos questions de recherche. Voici un aperçu rapide des méthodes qualitatives et quantitatives courantes :

Étape 3 – Sélectionnez les mesures : Décidez comment vous allez collecter et quantifier vos données. Pour la recherche qualitative, cela peut signifier coder des thèmes. Pour la recherche quantitative, définissez des métriques et des échelles claires pour garantir la cohérence.

Étape 4 – Collectez les données : Exécutez votre méthode choisie avec soin. Prenez des notes détaillées et restez cohérent entre les participants pour garantir la précision.

- Note : Que vous optiez pour le qualitatif ou le quantitatif, assurez-vous que votre recherche est éthique et équitable. Chaque participant doit donner son consentement éclairé et pouvoir retirer ses données à tout moment.

Étape 5 – Analysez et tirez des conclusions : Organisez les résultats, recherchez des tendances et mettez en évidence les surprises. Les données qualitatives peuvent être codées en thèmes ; les données quantitatives fonctionnent bien sous forme de graphiques, tableaux ou analyses statistiques.

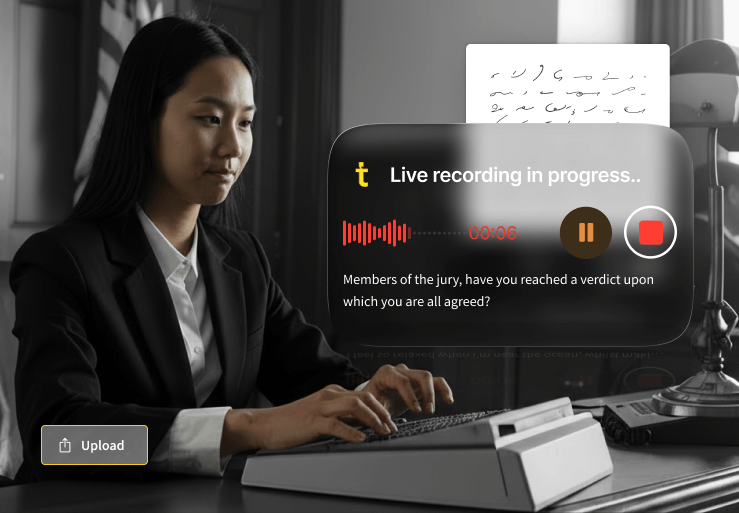

- Conseil : Vous analysez un entretien ? Ne perdez pas votre temps avec la transcription manuelle. Utilisez les services de transcription voix vers texte, audio vers texte ou vidéo vers texte de Trint pour obtenir des transcriptions avec jusqu'à 99 % de précision en quelques minutes. Nos outils peuvent également vous aider dans le processus de recherche, vous permettant de rechercher facilement des tendances dans votre transcription.

La recherche secondaire

Qu'est-ce que la recherche secondaire ?

Si la recherche primaire revient à acheter un jean neuf, la recherche secondaire revient à en trouver un en friperie. Il n'est pas neuf, mais peut être réutilisé pour quelque chose de nouveau.

Aussi appelée recherche documentaire, la recherche secondaire consiste à utiliser des données déjà collectées par quelqu'un d'autre. Bien qu'elle repose sur des données préexistantes, cela ne signifie pas qu'elle n'est pas précieuse. En réexaminant les données sous un angle différent, vous pouvez révéler de nouvelles tendances et perspectives. Utiliser des données secondaires est aussi généralement moins cher et moins chronophage.

Cela dit, la recherche secondaire n'est pas sans inconvénients. Elle n'est pas adaptée à votre question exacte, vous pourriez donc avoir du mal à obtenir des réponses spécifiques. De plus, si les données ne sont pas valides, fiables ou à jour, vos conclusions risquent d'être fragiles.

Types de recherche secondaire

Comme la recherche primaire, la recherche secondaire se présente sous de nombreuses formes, incluant des approches quantitatives et qualitatives. Voici les types les plus courants de recherche secondaire :

- Rapports publiés : Les publications gouvernementales, livres blancs ou rapports de think tanks peuvent être des mines d'or pour des données fiables.

- Études universitaires : Les articles évalués par des pairs et les thèses fournissent des informations approfondies soutenues par une méthodologie rigoureuse.

- Archives médiatiques : Enregistrements, transcriptions et archives de diffusion vous donnent accès à la façon dont les sujets et les événements ont été couverts au fil du temps.

- Données commerciales : Les bases de données par abonnement et les recherches de cabinets spécialisés fournissent des informations prêtes à l'emploi (à un certain prix).

- Réutilisation des données internes : Ne négligez pas ce que vous avez déjà. Qu'il s'agisse d'anciens registres de ventes pour le commerce de détail ou d'entretiens existants pour les journalistes, l'analyse des données existantes peut révéler des tendances que vous auriez pu manquer.

Comment mener une recherche secondaire

Avec la recherche originale, vous allez collecter les données vous-même. Mais en quoi consiste la recherche documentaire ? Voici une approche simple étape par étape pour mener une recherche documentaire.

Étape 1 – Définissez le problème : Que devez-vous savoir et pourquoi ? Définir clairement cela vous aidera à choisir la source de données secondaires la plus appropriée.

Étape 2 – Choisissez votre méthode de recherche : Choisissez le type de méthode de recherche sur lequel vous souhaitez baser votre recherche secondaire : rapports, études universitaires, archives médiatiques, bases de données commerciales, données internes ou un mélange.

Étape 3 – Trouvez des sources fiables : La crédibilité et la fiabilité sont primordiales avec les données secondaires. Recherchez des données fiables provenant de sources faisant autorité, comme les documents gouvernementaux, les revues universitaires reconnues, les sources médiatiques de confiance ou vos propres données internes.

- Conseil : Les données peuvent devenir obsolètes rapidement, assurez-vous donc d'utiliser la version la plus récente.

Étape 4 – Évaluez : Ne vous contentez pas de collecter les informations : interrogez-les. Lisez-les attentivement et demandez-vous :

- Qui a produit ces données ?

- Quand ont-elles été collectées ?

- Pourquoi ont-elles été publiées ?

Ces points importants doivent être mentionnés dans votre propre recherche pour le contexte.

Étape 5 – Analysez et tirez des conclusions : Organisez vos données et recherchez des tendances, des lacunes et des connexions entre vos sources. Demandez-vous comment la recherche existante soutient — ou remet en question — vos questions.

Étape 6 – Combinez avec la recherche primaire (optionnel) : Vous avez du mal à choisir entre recherche primaire et secondaire ? Ce n'est pas forcément l'un ou l'autre. Vous pouvez commencer par la recherche secondaire pour le contexte, puis utiliser la recherche originale pour combler les lacunes et fournir des informations plus ciblées.

Recherche primaire vs secondaire : Avantages et inconvénients

Alors, dans le duel recherche secondaire vs primaire, laquelle l'emporte ? Eh bien, cela dépend. Le bon choix repose sur des facteurs comme la qualité des données secondaires existantes, la disponibilité des ressources, vos questions de recherche et votre budget.

Avantages de la recherche primaire :

- Originale

- Adaptée à votre question de recherche exacte

- Actualisée

- Avantage concurrentiel

Inconvénients de la recherche primaire :

- Chronophage — vous voulez accélérer les choses ? Découvrez les 10 meilleurs outils de recherche pour booster votre productivité

- Coûteuse

- Nécessite une expertise

- Parfois difficile de recruter des participants

Avantages de la recherche secondaire :

- Économique

- Plus rapide d'accès

- Large éventail de données à explorer

- Utile comme base avant la recherche primaire

Inconvénients de la recherche secondaire :

- Pas originale

- Pas adaptée

- Peut être obsolète

- La qualité des données disponibles varie

Toujours pas sûr de quelle option choisir dans la bataille recherche primaire vs secondaire ? Consultez notre tableau comparatif :

Que vous meniez des sondages, conduisiez des entretiens ou exploitiez des données existantes, choisir la bonne méthode de recherche primaire ou secondaire fait toute la différence.

Avec la transcription IA de Trint, vous pouvez transformer les entretiens et groupes de discussion vocaux, audio et vidéo en transcriptions précises en quelques minutes, vous laissant le temps de vous concentrer sur l'analyse des données. Inscrivez-vous pour un essai gratuit dès aujourd'hui pour découvrir ce que vous manquez